Employment income e-BE on or before 15 th May. In a statement released today LHDN urged taxpayers to keep important details up.

Tax Day Is Coming Soon Here S What You Need To Know About Filing Your 2021 Taxes Chicago News Wttw

As the first deadline to file your income tax has just passed you may be wondering what could happen if you file your taxes late.

. By 31 March of the following year. For Labuan entities taxed under the Malaysia Income Tax Act 1967 ITA the 3-months extension only applies to taxpayers whose accounting period ended on 30 November 2020 and 31 December 2020. Individual Tax Relief in Malaysia.

Income Tax For Foreigners Working in Malaysia 2021. The Inland Revenue Board IRB says that the deadline to submit the Tax Return Form for the Year of Assessment 2021 non-business income is on April 30 for manual submissions and May 15 via e-Filing. No extension for income tax filing.

Other entities Submission of income tax return. Tax return filing and payment deadlines extended by two months March 23 2020. In a statement today IRB also advised taxpayers to submit the Tax Return Form and.

2021 income tax return filing programme issued. Declaration report of companies Form E deadline. Of tax professionals will be able to assist you in the aspect of tax planning and compliance so as to comply with the Income Tax Act.

The Government has announced an extension of two months for filing income tax from the original deadline in consideration of the Movement Restriction Order MRO that has been enforced during the COVID-19 pandemic. The deadline for filing income tax in Malaysia also varies according to what type of form you are filing. For example a company that closes its accounts on 30 June of each year is taxed on income earned during the financial year ending on 30 June 2022 for year of assessment 2022.

For further information kindly refer the Return Form RF Program on the. Although a partnership is not subjected to pay tax it still has to file an annual income tax return Form P to show all income earned and business expenses. Extended from 15 July 2021 to 31 Aug 2021 according to LHDN.

Business income B Form on or before 30 th June. Form E Important Notes. In a statement today IRB also advised taxpayers to submit the Tax Return Form and pay their income tax within the stipulated.

The deadline for filing income tax in Malaysia also varies according to what type of form you are filing. As for those filling in the B form resident individuals who carry on business the. Personal income tax filing Form BE deadline.

Individual Tax in Malaysia. Deceased persons estate Association. Meanwhile for the B form resident individuals who carry.

Malaysia has implementing territorial tax system. Extension of Two Months for Filing Malaysia Income Tax 2020. CompareHeromy April 5 2021 14360.

Under the self-assessment system companies are required to submit a return of income within seven months from the date of closing of accounts. The Malaysian Inland Revenue Board MIRB has set out a new timetable for certain personal tax filing and employer compliance obligations including due date extensions in light of the COVID-19 crisis. 2022 tax filing deadlines.

The tax submission deadline under ITA is usually within 7 months after the end of accounting period. Foreign income remitted into Malaysia is exempted from tax. The 2022 filing programme stipulates that the Form E and CP8D ie Statement of Remuneration from Employment for the Year ending 31 December 2021 and Particulars of.

Yearly remuneration statement Form EA Deadline. For further information consult the dedicated page on the official website of the Inland Revenue Board of. Tax Deadline Year 2022.

According to the BE form resident people who do not engage in business the deadline for reporting income tax in Malaysia for manual filing in 2020 is 30 April 2021 and for e-filing in 2020 is 15 May 2020. Form B Form B deadline. By 30 April without business income or 30 June with business income in the year following that YA.

Also the MIRB has closed all its office premises until 14. Income tax return for partnerships. Income Statutory deadline March 31 2020 April 30 2020 June 30 2020 Existing grace period - based on method of submission Electronic filing 1 month April 30 2020 15 days.

The Inland Revenue Board LHDN is reminding Malaysians that the deadline for filing and submitting their income tax forms is fast approaching. LEMBAGA HASIL DALAM NEGERI MALAYSIA HASiL ANJUR PERSIDANGAN PERCUKAIAN KEBANGSAAN 2022 KALI KE-22. SOLE PROPRIETOR Form B.

Meanwhile the deadlines for the B form resident people who are engaged in business are 15 July for e-filing and 30 June for manual. The Inland Revenue Board IRB has recently made available on its website the 2021 income tax return filing programme 2021 filing programme titled Return Form RF Filing Programme For The Year 2021. Malaysia Various Tax Deadlines Extended Due to COVID-19.

For the BE form resident individuals who do not carry on business the deadline for filing income tax in Malaysia is 30 April 2021 for manual filing and 15 May 2021 via e-Filing. Both residents and non-residents are taxed on income accruing in or derived from Malaysia. For the BE form resident individuals who do not carry on business the deadline falls on either 30 April 2022 manual filing or 15 May 2022 e-Filing.

Thursday 14 Apr 2022 814 PM MYT. Business income e-B on or before 15 th July Date of online submission may subject to change. Tuesday 08 Mar 2022.

The 2021 filing programme is broadly similar in concept to the position laid out in the. Form P refers to income tax return for partnerships. The 2022 filing programme stipulates the due date for the submission of the RF ie Form BT e-BT for resident individuals who are non-citizen workers holding key positions.

The new deadline for filing income tax returns in Malaysia is now 30 June 2020. PERSONAL TAX Form BE 30 April 2022. However with this extension taxpayers have a total.

Information on Taxes in Malaysia. Income tax return for partnerships Form P. The Inland Revenue Board LHDN will not offer any extension period and reminded all taxpayers to.

Income Tax Return Forms ITRF in the non-business category for assessment year 2019 have to be submitted by 30th June. Form EA Important Notes. Employment income BE Form on or before 30 th April.

KUALA LUMPUR April 14 The Inland Revenue Board IRB says that the deadline to submit the Tax Return Form for the Year of Assessment 2021 non-business income is on April 30 for manual submissions and May 15 via e-Filing. Kuala Lumpur 02 Ogos 2022 - Lembaga Hasil Dalam Negeri Malaysia HASiL dengan kerjasama Chartered Tax Institute of Malaysia CTIM hari ini menganjurkan Persidangan Percukaian Kebangsaan 2022 National Tax Conference.

Business Tax Deadline In 2022 For Small Businesses Shopify Philippines

Irs No Penalty For Filing Taxes Late If You Re Getting A Refund

Tax Day Stock Photos Royalty Free Tax Day Images Depositphotos

7 Steps To Take Now To Make Tax Filing Easier Next Year Gobankingrates

Business Tax Deadline In 2022 For Small Businesses Shopify Philippines

Hong Kong Guide Profits Tax In Hong Kong Asia Briefing Country Guide Portal

Tax Deadline Stock Photos Royalty Free Tax Deadline Images Depositphotos

How To Amend An Incorrect Tax Return You Already Filed 2022

Tax Day Stock Photos Royalty Free Tax Day Images Depositphotos

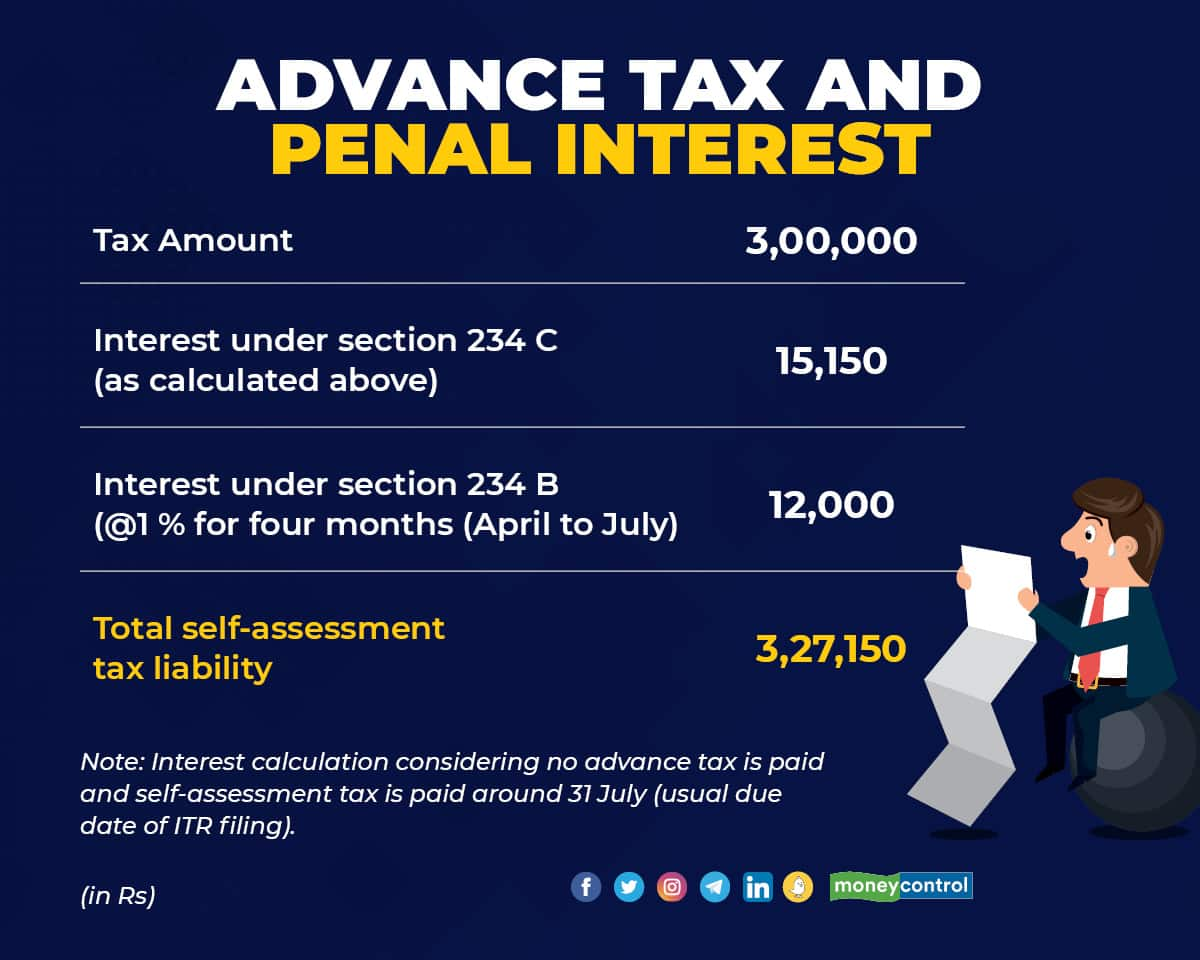

Have You Paid Your Advance Tax The Fourth And Final Instalment Of Advance Tax For Fy 22 Is Due Today

Irs No Penalty For Filing Taxes Late If You Re Getting A Refund

Tax Deadline Stock Photos Royalty Free Tax Deadline Images Depositphotos

Cbdt Extends Itr Filing Deadline For Audit Cases By A Month To Oct 31

1099 Tax Return Contractors Small Business Freelancer Bookkeeping Business Small Business Accounting Small Business Bookkeeping